Many things in life are simple, straightforward, and to the point. Buying a home is, well, not a single one of those.

Recently, we shared a post with first-time homebuyer advice — direct from the BuzzFeed Community — and luckily, readers still had a lot more advice to relay to those looking to buy their first home.

These are some of the best tips we read, straight from the folks who wish they'd done things differently the first time around. Even if homeownership is still on the horizon for you, it's never too early to get a head start.

1. "Be careful about condos. Although they seem like a good way to afford a home on a budget, sometimes the homeowners associations can be overbearing — and the financial stability of the HOA is never a guarantee. I live in Florida, and apparently, here most of the HOAs do not have reserve funds (basically savings accounts) with enough money to cover things like roof replacements and parking lots. So when that happens, they conduct a ‘special assessment’ where every homeowner has to chip in to pay for the needs. That’s in addition to the monthly fees, which mostly just cover operating expenses. This year, I owe $4,300 for the new roof THEY are putting in — and that’s after the HOA’s insurance paid for half of it. Big yikes, and the financial situation of the HOA has me in the market for a new job so I can afford a house without one..."

"I wish someone had explained condo HOAs to me better. They are VERY different than a typical association due to all of our homes being attached to each other!"

—Courtney H., Facebook

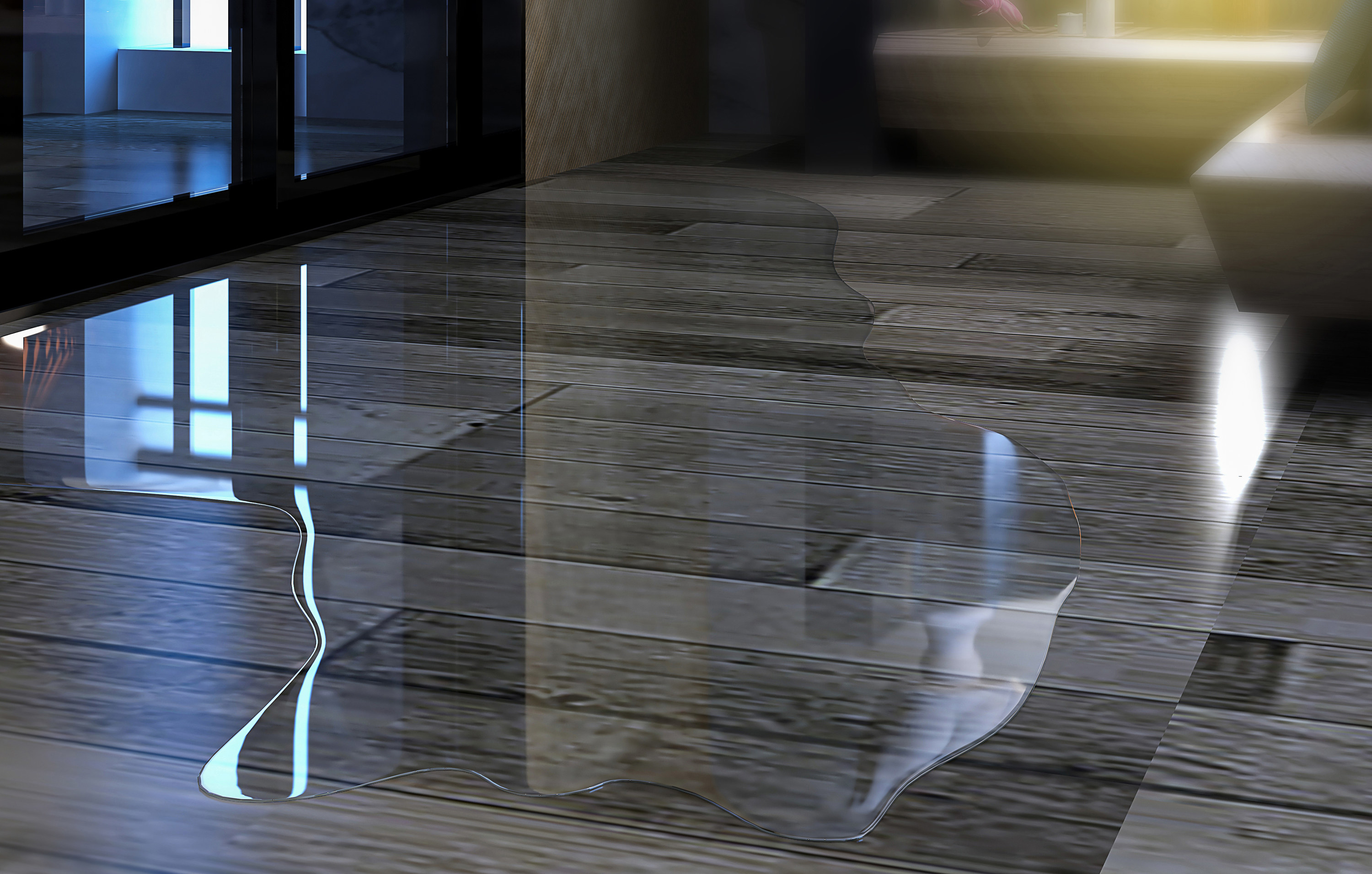

2. "If you find that the seller or seller's agent is being dodgy with certain questions, your insurance agent can run a claim history report on the home to see what claims have been made against it. Sellers are hardly forthcoming with info, but if there are multiple water issues, for instance, you can walk away because it may be ongoing."

—Heather P., Facebook

3. "If you’re buying a new build — at least in my area of the Northeast — the builder will install what's called a 'passive radon mitigation system.' It’s the framework for an active system, should you choose to install one. We didn’t know that they don’t actually test the new homes for radon, but we were required to test when we went to sell it. Turns out that our home had 50 times the safe limit of radon, even though it was only 5 years old. We spent $3500 installing the active system after the fact. The scary part? My kid and I had chronic coughs that completely went away when the active mitigation system began working. Radon is highly toxic and cancerous, and is nothing to mess around with. Insist on a test if you want to live in an area known to have issues with it."

View this video on YouTube

4. "Understand what will happen if home values do drop, and in the current market, that's a very possible reality. My mother-in-law is trying to get underwater mortgage relief because what she owes on her house is more than the current value of her home — she can't refinance her mortgage for the same reason. She wants to retire and move in the next few years, and it’s heartbreaking to know that she will not come out of this without losing money. She really did not understand the loan terms (or the risk) when she bought 20 years ago, and since her city was hit hard by the 2008 recession, it never fully recovered."

5. "When it comes to the overall amount of house you can afford: buy less, buy less, buy less. For couples, assume that one of you could be out of work for extended periods of time (because life), and you'll need to be able to keep living on one income!"

6. "Mortgage closer here. Before you even start house hunting, think for a while about how long you actually plan on staying in one place and get really honest with yourself. On average, it takes about 3–5 years to recoup your closing costs, depending on your loan and the real estate market in your area. Many people sell their homes before those costs can even be worth it in the first place."

7. "Licensed termite inspector and exterminator here. These are my best pieces of advice: 1) Check behind the stove and under the dishwasher, since they're the most common places for mouse droppings (and everyone forgets to deep clean those areas). 2) Siding that continues below grade (especially with mulch) is a BIG no-no, and problems will ensue down the line when it comes to termites. 3) If you see spray foam insulation, that's also an automatic reject. Termites love to eat it and it covers any growing problems, making inspection almost impossible. 4) If a crawlspace entry is blocked or absent, huge red flag. Don't buy something you can't see the underlying structure of!"

8. "Insist that the sellers include a home warranty with the sale, or at least pay the first year's premium. My central A/C went out — in Texas — just months after I bought the home. The warranty covered it and I got a new $10,000 unit at no cost."

—Vicki H., Facebook

9. "Go through a homebuyer's workshop or class before you even start looking. In my state, you actually have to complete this to qualify for certain grants and incentives. My workshop was three parts: two different in-person classes, and then a one-on-one counseling session. Committing to one of these workshops is the best way to make sure you're prepared for every step of the home-buying process."

10. "When you're looking at online real estate sites, the monthly payment estimates are rarely ever accurate. We’ve had real estate agents actually tell us to completely disregard those websites since they can be so misleading."

11. "When your inspection finds problems here or there, the general solution is to ask the owner to fix them before proceeding with the sale. However, you should consider asking for the money instead, or adjust the offer lower as necessary. Why? The seller is likely going to choose the cheapest fix or bid, and that really won't serve you as the new owner in the long run."

12. "As a buyer, always use a realtor! Buyers don't pay their commission — the seller pays all agent commissions at closing, which is why it can benefit sellers to not use a listing agent if they're savvy enough to do a for sale by owner. If you're buying a home from someone in your own family and want to skip the realtor fee, don’t skip the inspection, too. We bought our first house from family and they totally took advantage of our ignorance. We trusted they we treating us right because of the very close relationship…wrong, very wrong."

13. "One HUGE thing I didn't know: your sewer line is not covered under basic homeowner's insurance. We had a house with an 80-year-old sewer line that collapsed and caused some minor basement flooding. Fortunately, my husband bought supplemental insurance so replacing the line was covered for us...but our neighbors got a $10,000 bill for something totally out of their control. Carefully inspect what is and isn't covered in your policy. You don't want to end up on the hook for a huge bill unexpectedly if you can avoid it."

14. "Being house poor is a real thing! When we called about a loan, the mortgage officer asked us 'how much do you want to be qualified for?' In other words, he was going to allow us to set our own budget — hopefully within reason. Say we overestimated. Then what? Bankruptcy? Assume you're going to spend more than you anticipate because of the added fees. For instance, it's not going to feel so good after you've just thrown down $40,000 for a down payment to also have to pay for the inspector and add a home to your insurance policy. You may have bought your 'dream home,' but you better like it, because now you can't treat yourself to a nice latte for the next 10 years...let alone a vacation or celebratory dinner with friends."

15. "We bought our house last year. Since we were moving almost four hours away, we tried to see a bunch of properties over one weekend, but none felt right. When our eventual home came on the market, we were unable to go up again, so our realtor did a Zoom walkthrough with us. My husband went up for the in-person inspection but was only able to be in the house for about 30 minutes before he had to come home. I was on crutches at the time of closing, so I only got to look at the house once before it was ours..."

"It wasn't until we closed and started moving in that we realized our house only had three bathrooms...even though it was listed and sold as a four-bathroom house. Not a single person ever said anything about it not having four bathrooms! There's a place in the basement where there apparently used to be a bathroom, but it had been gutted. Now, there are just holes in the floor where the toilet and sink used to be. As a result, we're forced to re-build the basement bathroom unless we want to lose money when we re-sell."

—Hannah S., Facebook

16. "Take a small ball (tennis ball, golf ball, whatever) with you when you go to see a house, especially if it's an older one. Put it on the floor and see if it rolls. You will feel very silly, but it’s much better than having to spend tens of thousands to level floors you didn’t notice were slightly sloped before you can do anything else to your home. This advice is from the person who did *not* bring a ball."

17. "View your house while it’s raining! Our inspector was actually good — he measured the moisture in the walls and it wasn’t heart-stoppingly high, but it was June in North Carolina after all, and generally pretty dry. Come fall (with a bunch of rain), we suddenly had to pay $10,000 to install a French drain, or our mudroom, laundry room, and shop would have literally been underwater."

18. "Come prepared, ask all your questions, and leave nothing unturned during your inspection...since you can’t inspect the home even more after it's over. Unless the seller allows it — and they may if you're setting up a follow-up visit with HVAC, plumbing, or electric professionals — you can’t enter the home or step foot on the property until the deal closes and the move-in date arrives."

—Lindsey J., Facebook

19. "If you can, bring your parents or another responsible, experienced homeowner when getting close to a final decision. My husband and I absolutely fell in love with a fixer-upper we were looking at... and we almost bought it. We brought both of our parents and my older brother to see it, but they talked us out of it because they know us. They know we would have actually been miserable. We ended up in the perfect house for us after all, and I'm so glad we took their advice (and were able to get it in the first place)."

20. "If you can, try to avoid buying a house during the winter. We live in Ohio and bought our first house in February 2014. The neighborhood was 'quiet,' but stupidly, we didn’t even think about the fact that it was 20 degrees outside and no one was out and about. That May when it warmed up, our 'quiet' neighborhood turned into a nightmare once all of the neighbors and what seemed to be the 500 kids living on our street began to come outside. We lasted for about five years, and then we finally had to get out of there."

—Kate L., Facebook

21. "Do NOT rely on the $500 inspection to give you any real information about the integrity of the home. If your home is more than 20 years old, spend the extra money to get a plumber and an electrician to inspect the house. If there is an underlying issue, it can cost you a fortune down the line. I learned this the hard way: Our listing said "replaced pipes in 2013," but that was literally just the inbound water lines. I spent $20,000 replacing the underground sewer pipes that my insurance refused to cover the full amount on."

22. "Never, ever, ever use a dual agent realtor representing both you and the seller. A lot of states outlaw that for a reason, but it's still legal in many places! There is no way a realtor can work in the best interest of both parties — it’s literally like if a lawyer represented a plaintiff and a defendant. If you like a home your realtor happens to be representing, find another realtor they like working with. A friend of mine ended up with a terrible deal because he agreed to a dual agency."

23. "Don’t trust your home inspection to catch everything, so make sure you're looking around at everything, too. Two days after closing, we found the previous owner shoved a towel behind the fridge to cover up a leak — but our home inspector wasn’t 'legally obligated' to pull the fridge back during our inspection. We ended up needing to replace the fridge, fix all the surrounding dry wall, and pay for mold remediation in the kitchen."

24. "People aren't kidding when they say you'll need to provide documentation for all your income when you apply for a mortgage. I had to source a $1,200 cash deposit before we even started looking for houses. I couldn’t figure out what it was at first, and then I remembered it was a casino win. Luckily, I happened to have taken a picture of the voucher to text my mom. I also got asked every two weeks to source my 'deposits of a few thousand dollars,' no matter how many times I explained that most adults receive these deposits bi-weekly and call them...paychecks."

—Natasha K., Facebook

25. "Pay close attention to the school district you're buying into, even if you don't have (or never want) kids yourself. When you buy property in a desirable school district, you'll widen the array of potential buyers – because believe it or not, you will have to sell your home one day."

26. "If the house you're looking at hasn’t been sold in over 30 years, spend a little more time looking in all the nooks and crannies, and make sure the inspection is as thorough as possible. When people have stayed in homes that long, it's generally a great sign of 'good bones,' but there was also likely a lot of work done by the homeowner over time — and it may not have been done properly."

27. "If you're considering making an offer, meet the neighbors. Ask about the neighborhood. Be very aware that if a house next door is a rental property, the people living in it could change every year...and they might not be the great neighbors you meet the day you toured the home. Three of the five renters we've experienced in the house next to ours have been incredibly problematic."

28. "Never buy a flip. Just don't buy them — and this is coming from someone who bought one. Contractors can do absolute garbage work every now and then, but even they do better work than flippers who are aggressively gentrifying neighborhoods with shiplap and gray accents. You're better off buying a cheaper house with a lot more problems than you would be buying a flip. I have a pile of crap yet to fix on my place and we're just past the three-year mark."

29. "Ask if the home has ever been a rental. The daughter of the previous owner was the last person to ever live in our home, so they didn’t technically have to list it as a rental...but I found out from neighbors after I moved in that the home had been one for nearly 20 years. There were so, so many problems — the doors were literally held together with duct tape and paint."